Student Loan Forgiveness Application: Your Path to Debt Relief

In today’s challenging economic landscape, student loan debt can be a heavy burden for many. However, there’s a ray of hope in the form of student loan forgiveness programs. To embark on this journey towards debt relief, understanding the student loan forgiveness application is crucial. In this comprehensive guide, we’ll take you through the intricacies of the application process, provide insights, and answer FAQs to help you on your path to financial freedom.

What Is the Student Loan Forgiveness Application?

The Student Loan Forgiveness Application is the gateway to potential debt relief for millions of borrowers. It’s a formal request submitted to your loan servicer, expressing your intention to have a portion or the entirety of your student loans forgiven, canceled or discharged.

Navigating the Application Process

Applying may seem daunting, but with a clear understanding, you can tackle it effectively. Here’s a step-by-step guide:

Determine Eligibility: Before applying, ensure you qualify for the forgiveness program you’re interested in. Eligibility criteria may vary depending on the program.

Gather Necessary Documentation: Collect all required documents, such as income verification, loan details, and proof of employment.

Choose the Right Program: Select the forgiveness program that aligns with your circumstances, whether it’s Public Service Loan Forgiveness (PSLF), Income-Driven Repayment Plans, or Teacher Loan Forgiveness.

Complete the Application: Fill out the application accurately and thoroughly. Any mistakes can delay the process.

Submit and Await Review: Send your application to your loan servicer and patiently await their response.

Follow-up: Stay proactive by keeping track of your application’s status and addressing any additional requests promptly.

Benefits of Student Loan Forgiveness

Lighter Financial Burden

The primary benefit of the student loan forgiveness application is the potential for significant debt reduction or even complete forgiveness. This relief can free you from the shackles of student loan debt, allowing you to focus on your financial goals.

Improved Credit Score

As your loan balance decreases or gets eliminated, your credit score may see a boost. A better credit score opens doors to various financial opportunities.

Peace of Mind

Knowing that your student loans are on the path to forgiveness can bring peace of mind. It allows you to plan your financial future without the constant worry of overwhelming debt.

Best Content For You

- Top 10 Best Mesothelioma Law Firms In the U.S

- The Benefits of Working with an Experienced Asbestos Lawyer

- Top 10 Best Insurance Companies In The US: Expert Picks

- The Most Reliable Life Insurance Companies of 2023

- The Auto Advocates: The Best Texas Lawyers For Accident Cases

Student Loan Forgiveness Application FAQs

Q: Can I apply for student loan forgiveness if I’m still in school?

A: Generally, forgiveness programs require that you’ve completed your studies and made a certain number of qualifying payments. However, some exceptions may apply.

Q: Are private student loans eligible for forgiveness?

A: Unfortunately, private loans are typically not eligible for federal forgiveness programs. You’ll need to explore alternative options, such as refinancing.

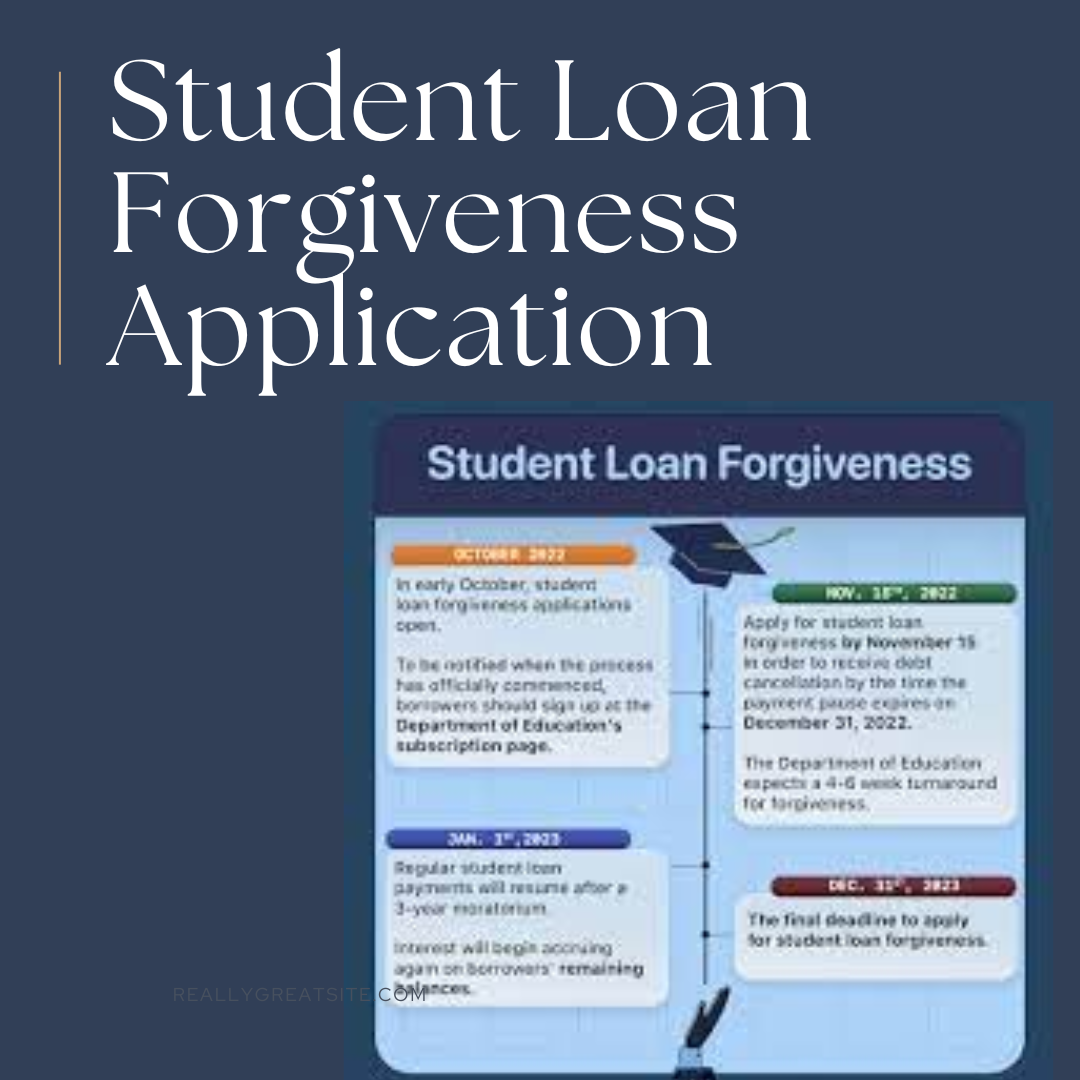

Q: Is there a deadline for applying for forgiveness?

A: Deadlines vary among programs. It’s essential to stay informed and submit your application within the specified timeframe to be eligible.

Q: How long does it take for forgiveness to be granted?

A: The processing time can vary, but it may take several months to a year or more. Patience is key during this period.

Q: Can I apply for multiple forgiveness programs simultaneously?

A: In some cases, you may be eligible for multiple programs, but they usually have different requirements. Carefully assess your qualifications for each before proceeding.

Q: What happens if my forgiveness application is denied?

A: If your application is denied, don’t lose hope. You may have options for appeal or alternative repayment plans.

Conclusion

The student loan forgiveness application is your beacon of hope in the quest for financial freedom. By understanding the process, staying informed, and following the steps diligently, you can pave the way for a brighter, debt-free future. Remember, while the journey may be challenging, the destination is worth the effort.